Contact us for customized solutions to lower your attrition rate and enhance business growth.

Whether you're familiar with the term "attrition rate" or "customer churn" or not, every business and its customers contribute to it daily. Is it good or bad? The answer varies and relies on several factors like customer satisfaction and unique business traits. No one, including the biggest global companies, is immune to losing loyal customers. Business leaders must understand every aspect of this issue to grow and succeed.

Let's start by defining customer churn or turnover, then discuss what a good rate looks like, and finally, explore ways to keep customers from leaving for good.

Defining customer attrition

Customer attrition, also known as churn, defection, or turnover, happens when customers stop buying products or using services from a company. Different businesses have their ways of identifying when a customer has churned, usually based on a specific period without any purchases or engagement.

Companies that rely on long-term customer relationships must pay close attention to customer attrition rates. The end of a business relationship with a client can take various forms, such as:

- Deleting an account;

- Canceling a subscription;

- Ending a long-term service contract early;

- Choosing to use a different service provider.

To understand customer churn in your business, analyze data to spot customers who are likely gone for good. Look for actions like those listed above. Once you have a clear picture, you can use this information to calculate your churn rate.

How to calculate attrition rate

Calculating attrition, or turnover, can be done in different ways. Businesses vary, so managers might focus on gross or net turnover. Gross turnover involves counting all customers and profits lost over a certain period. Net turnover, on the other hand, considers new customers and profits gained in the same period. Here’s how companies can calculate customer turnover:

- Counting the number of customers lost.

- Expressing customer loss as a percentage.

- Figuring out the decrease in regular business income.

- Calculating the percentage decrease in regular income.

1) The classic gross turnover rate formula is pretty simple and applies to the first two points:

The number of customers churned by the end of the period is divided by the total number of clients at the beginning of the period.

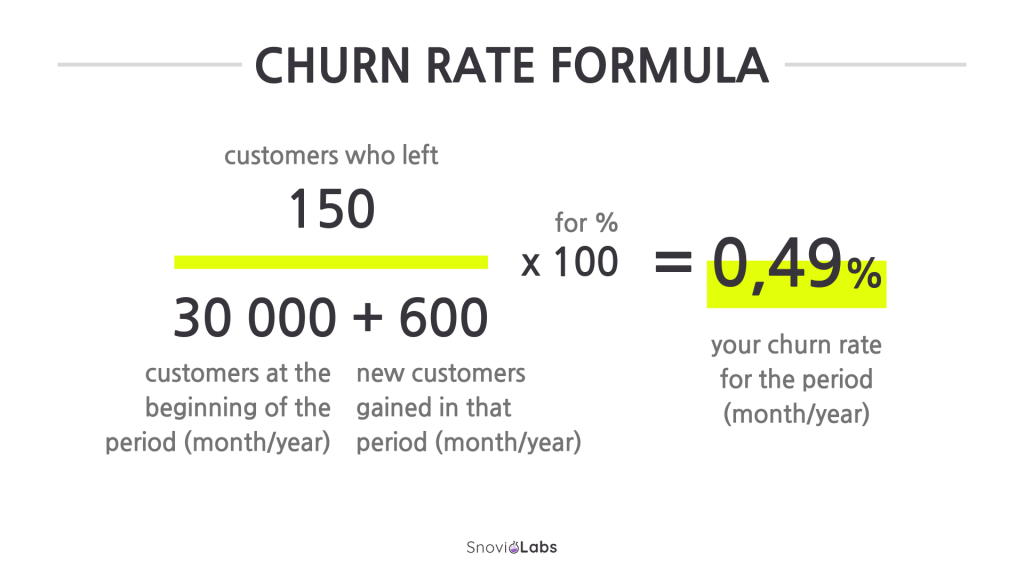

2) However, this formula can be expanded to include new customers gained during the period:

This gives a more complete picture and usually results in a lower attrition rate. For example, if a company adds 1,250 new customers to an existing base of 40,000 in one month, the attrition rate will be lower. Both formulas are useful and offer different perspectives.

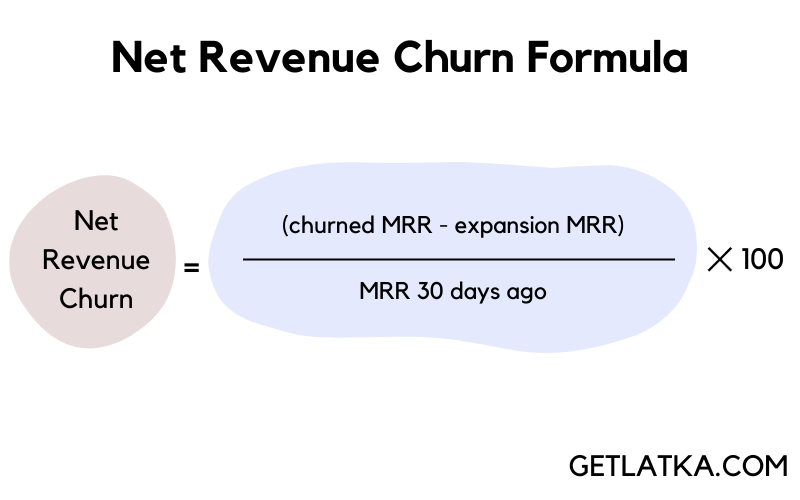

3) But what about revenue-based calculations? For these, companies often use monthly recurring revenue, which is the predictable income expected over a period. The revenue churn formula is a bit more complex, as it can yield both positive and negative results:

A lower result is generally better. For instance, if a company’s expected revenue was $300,000 at the start of the month but dropped to $250,000 by the end, calculating gross revenue churn shows the impact of customer downgrades on expected revenue. However, if existing customers contribute an additional $60,000 in the same period, the net revenue churn formula becomes useful:

Net Revenue Churn (NRC) = ($300,000 – $250,000) – $60,000 / $300,000 = -$10,000 / $300,000 = -3.3%

A negative result indicates the company offset its expected revenue losses with upsells from existing customers.

Different businesses use different methods for calculating turnover rates. Therefore, defining a “good” or “bad” attrition rate is hard, as it varies by industry and measurement method. For example, SaaS companies often report 5-7% attrition rates, while European phone carriers range between 20-38%. Companies usually don't share data on lost customers, so exact figures are uncertain.

Additionally, two other metrics are useful for understanding customer interactions: retention and acquisition rates. Retention rate shows the percentage of customers kept over a period, while acquisition rate refers to the number of new customers gained. These metrics and the attrition rate provide a complete picture of customer dynamics.

Why does tracking customer attrition matter?

Tracking customer attrition rate is crucial as it's a key performance indicator (KPI) for managers. This helps in making strategic decisions. Many industry statistics show that keeping existing customers is generally cheaper than acquiring new ones. By identifying customers who are leaving early, you can pinpoint issues and avoid costly efforts to gain new customers.

High customer turnover rates, as indicated by the formulas, could signal major issues such as:

- Flaws in your business offerings.

- Weak management of customer relationships.

- Failures in customer experience.

- Technical issues with your products or services.

It is important to calculate turnover rates regularly. If the numbers are concerning, you can take logical steps and monitor their impact on weekly or monthly statistics. Eventually, you'll discover ways to improve customer retention and increase their lifetime value.

Analyzing customer churn rate offers many advantages:

Firstly, it helps you understand your overall business losses by knowing how many clients leave and their average value.

Secondly, it lets you figure out the new sales needed to offset these losses.

Thirdly, by comparing attrition and retention rates, you can identify trends and reasons why customers stay or leave. Understanding whether attrition is passive or active (voluntary or involuntary) is crucial. Knowing why clients leave – whether they prefer another service or lose interest in your offer – enables you to address problems effectively.

How to reduce customer attrition in business?

There are several effective strategies to improve customer retention. Now, let's explore the best methods. Our expert team at the professional outsourcing contact center has compiled a list of the most successful techniques based on our extensive experience with clients from around the world:

Love at first sight

Customers who are immediately impressed by a product are less likely to search for alternatives. Your business's main goal should be to captivate new customers within the first five minutes of their experience with your service or product. In this critical time, they should easily find what they need and quickly see positive results. They might think, "Wow! This is great, and it's only going to get better! Maybe I don't need to look elsewhere."

A successful first interaction often leads to a lasting commitment. Generally, the better the initial experience, the stronger and longer-lasting the customer relationship will be.

Show that you care about customers

Show you care about your customers! Make sure they don't feel neglected by offering quick and helpful customer service. This shows you take your responsibilities seriously. For example, when Simply Contact provides inbound support, customers wait only a few seconds, not minutes or hours.

Being proactive is also key. Contact customers before they run into issues. This approach helps you solve problems before they escalate. After all, gaining new customers is much more expensive than providing quality service to existing ones and ensuring long-standing fruitful relationships.

Always surpass your customers' expectations

As mentioned earlier, making a strong initial impression with your offer is crucial. However, it's equally important to fulfill your promises. You should showcase your products in the best light but also be truthful with your customers to avoid misleading them. Many established companies recognize that failing to meet customer expectations is a leading cause of losing clients.

Promising too much can risk losing even your most loyal customers, especially when dealing with newcomers. The relationship begins with the first cold call or interaction. In their effort to earn more, your sales team might promise more than what can be delivered.

It's vital to give your sales team clear guidelines and ensure they don't promise beyond what your company can actually provide.

Customer feedback matters

Remember, businesses serve their customers, so valuing their feedback as much as management's opinions is essential. You can quickly address issues and reduce customer loss by listening to customers. Pay attention to those who seem unsatisfied.

For instance, if many complain about high prices, consider offering a trial period. This lets customers fully appreciate your service and understand its value. Always strive to meet customer needs with effective solutions. Even minor changes in policy or products can demonstrate to customers that their views are important and will be considered in future decisions.

Understand and address customer churn

Simply knowing how to calculate customer churn isn't enough. To effectively reduce it, you need to identify the underlying causes. Engage with customers who are leaving by asking them to share their reasons in a short survey or a polite farewell email. This feedback is crucial. Once you identify common reasons for churn, act quickly to resolve these issues.

What if you let them go?

This is not a joke. Sometimes, it's more cost-effective to let certain customers leave than to invest heavily in retaining them. Not all customers are equally valuable. Focus on loyal customers who generate the most revenue and promote your services. Evaluate the revenue potential, response to incentives, and cost-effectiveness before deciding on retention strategies. Regularly monitor customer turnover to ensure a healthy business.

Conclusion

Optimizing customer attrition rate is crucial for maintaining a healthy business. Key strategies include enhancing customer service, offering personalized experiences, and regularly analyzing feedback to identify and address common issues. By proactively managing and improving these areas, businesses can reduce customer attrition and foster a more loyal customer base.

Get fast answers to any remaining questions

Thank you.

Your request has been sent successfully.

Your request has been sent successfully.