At Simply Contact, we specialize in creating personalized customer support solutions that drive business growth and customer satisfaction. Let us help you elevate your customer experience and stand out from the competition.

Today, chatbots are bringing to life what science fiction writers have been stirring up in readers' minds for decades. Many of these software applications can not only carry on conversations with users, but also assist with tasks like verifying information, processing transactions, or even detecting fraud. Large institutions and regional banks are implementing them at an increasing pace to streamline business processes.

In this article, we will examine the trends shaping the market for AI chatbots in the banking industry, their practical applications, and the tangible benefits they can bring to businesses and clients.

Trends in AI chatbots for banking

Banks are increasingly adopting AI voice powered chatbots because these digital assistants enable support teams to efficiently handle a high volume of requests, particularly during peak periods on the platform.

Previously, things were very different: to resolve a problem, the client had to visit a branch or spend a considerable amount of time on hold waiting for a support agent to respond. Then, digital banks and IVRs (Interactive Voice Response Systems) emerged.

Today, AI chatbots for banks and financial services are capable of much more than just enhancing customer service. They not only help banks serve customers faster, but also automate internal processes, such as document verification and compliance monitoring. Furthermore, these bots enhance fraud protection, facilitate more accurate decisions in areas such as risk assessment and credit scoring, among other benefits.

Wondering which trends will be vital for banks in 2026 and beyond? Here they are:

- 24/7 support service using AI

- Advanced conversational AI to offer more empathetic support

- Real-time identification of fraudulent behavior

- Access management using AI

- Personalization of services using machine learning

- Automated creditworthiness assessment

- Forecasting financial risks

- Utilizing AI in facilitating internal audits and checks

What's happening nowadays?

Let's examine the 2025 statistics on banking AI chatbots.

- Six out of ten new bank platforms come with chatbots by default; now, automation is no longer a mere add-on.

- An AI-powered bot can handle an average of over 40,000 client requests per month, significantly saving time and resources.

- Support for 23 languages has made chatbots a worldwide phenomenon. They are used by customers worldwide, including at large institutions and regional banks.

- More than 1.8 billion banking customers already interact with chatbots, either directly or through automated workflows.

Use cases beyond basic banking tasks

Initially, chatbots in financial services sector were used for simple tasks. For example, they were used to check a balance, find the nearest branch, or block a card. However, their functionality is expanding.

- Loan applications support: A chatbot can collect applicant data, then conduct a preliminary credit check, and forward the request for evaluation to a human agent.

- Product guidance: AI chatbot answers questions about deposit terms, cashback, fees, and even compares tariffs.

- Sales and cross-selling: Based on customer behavior analysis, an AI bot can offer relevant services, such as insurance, investment solutions, and loyalty program cards.

- Onboarding and learning: Through game-like or interactive educational tutorials, a chatbot helps clients better understand the bank's digital services.

- Internal use: Bots are also being implemented to automate HR, IT support, and internal team communications.

Thus, chatbots become not just a tool for answering FAQs—they add real value for both customers and banking employees.

Business benefits of AI chatbots in the banking sector

The implementation of AI-based chatbots brings banks real business benefits. These advantages encompass a wide range of benefits, from enhancing the quality of customer support services to optimizing internal banking processes.

Cost reduction

It's no wonder that processing a customer request via a bot is several times cheaper than with the assistance of a human agent. It is especially noticeable during marketing campaigns or technical failures. All these events typically require a large number of employees to handle customer requests.

Quicker customer service

The AI chatbot for banks processes requests instantly, saving banking clients from long wait times. Improved service speed is especially crucial for a banking audience, as financial matters are often time-sensitive and require prompt attention.

Non-stop access

AI chatbots operate continuously, without breaks. Thus, customers can receive help whenever they need it, which enhances their satisfaction and fosters trust in the chosen bank.

Personalization

AI chatbots can adapt responses to the client's behavior and profile (personal characteristics and history of interaction with the bank), increasing engagement and loyalty.

Scalability

One banking chatbot can process tens of thousands of requests per month without increasing staff. A scalable system provides the same high-quality responses and speed regardless of the load, whereas people can become tired and make mistakes.

Reduced workload for employees

With AI assistants, routine tasks are automated, so agents can focus on more complex tasks that require empathy and human judgment.

Chatbots vs human agents: where's the balance?

The rise of artificial intelligence in banking means that chatbots, instead of employees, are performing an increasing number of tasks. These bots successfully replace people, especially when speed, scalability, and consistency are vital. This shift is already transforming the way financial institutions manage their staff workforce and allocate resources.

For example, the large Italian bank BPER Banca has announced plans to reduce its staff by approximately 2,000 employees by 2027 due to automation and the integration of AI. At the same time, the bank intends to hire 1,100 new specialists (in IT and analytics).

This example illustrates not only a technological shift, but also a shift in the kind of skills financial institutions need today.

Let's get back to our topic: where is the line between the tasks of chatbots and the role of a human agent?

- Chatbots are great at handling routine and frequently repetitive tasks, such as freezing a lost card, checking a user's balance, and updating contact information.

- AI chatbots are irreplaceable in high-load conditions and when it is necessary to scale up banking services.

- However, in situations where empathy, subtle interpretation of emotions, and analysis of complex or contentious issues are crucial, a human agent remains irreplaceable in their role. We discuss the consideration of complaints, loan negotiations, and the settlement of complex cases.

Thus, AI does not eliminate the need for human agents. It helps redistribute tasks, freeing employees from routine tasks. And it’s not just banking, nonprofits are also using AI-powered fundraising platforms to engage donors more effectively and automate parts of their giving process. Tools like these show how this technology is scaling impact well beyond finance.

Therefore, staff have more time to address issues that require greater intelligence, flexibility, and emotional involvement.

Real-world examples of banking chatbots in action

Let's examine several striking examples that demonstrate how chatbots in the banking sector modernize customer service and operational processes within banks and financial institutions, as well as the tasks they address.

Erica, the virtual assistant of the Bank of America, was launched in 2018 and has already processed more than 2 billion customer requests by 2024. The Erica chatbot is available 24/7 and assists with a range of requests, including checking balances, paying bills, and providing personalized support for financial management.

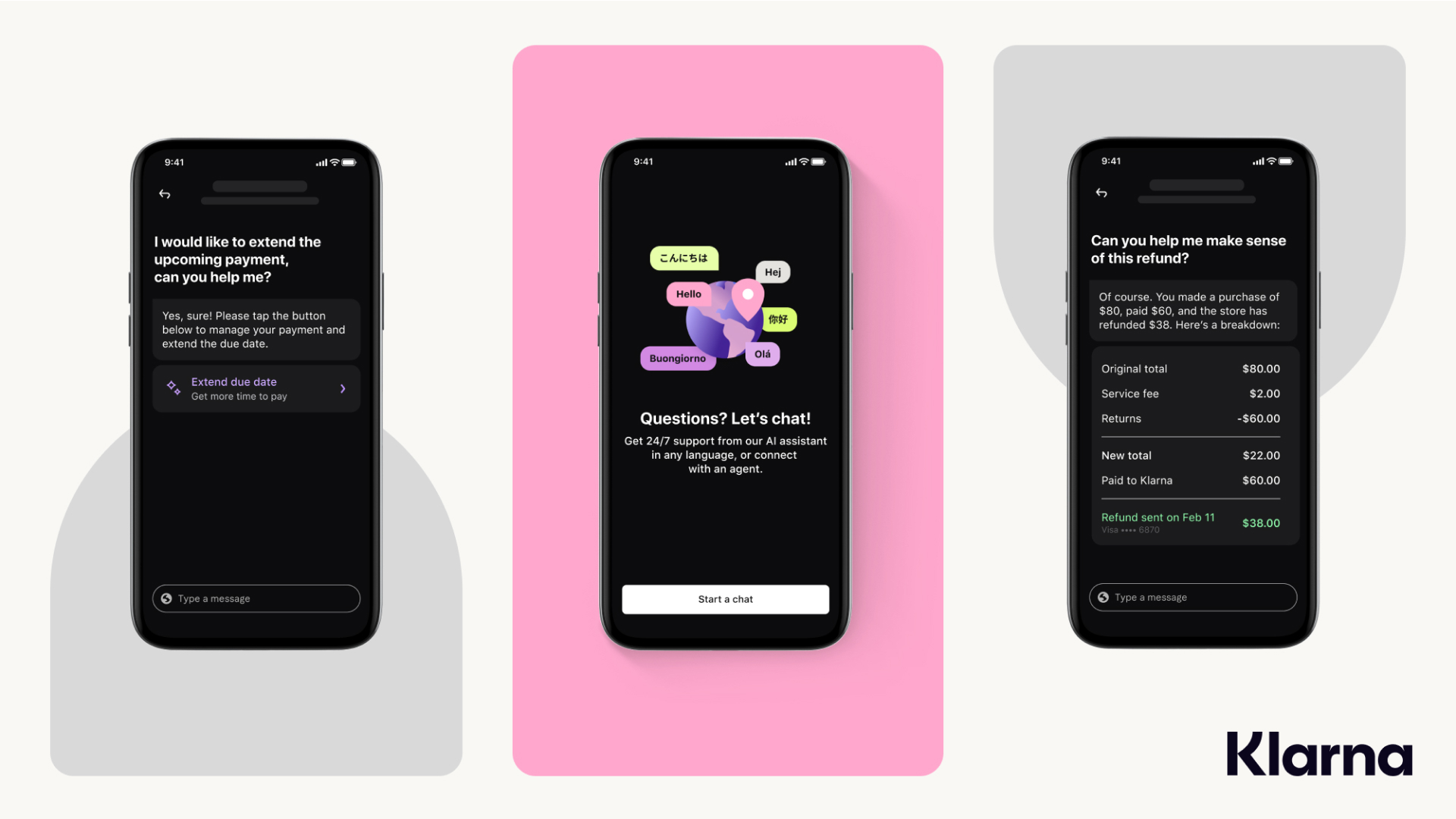

The AI assistant developed by Klarna, a fintech company, is a great example of a solution focused on improving the payment experience for customers. Accessible via the Klarna mobile app, this smart assistant handles approximately 2.3 million conversations annually. This advanced chatbot in banking replaces around 700 full-time employees — a remarkable achievement!

Barclays, one of the largest international banking and financial companies, founded in the UK, is also implementing chatbots to improve customer service. One of its chatbots helps customers with digital banking registration, finding the nearest ATMs (automated teller machines), and answering FAQs.

Moreover, this chatbot utilizes emotion analysis, which enables it to adapt responses and interactions based on the client's mood. It makes communication more human and helps increase customer loyalty. To ensure client data protection and correct execution of transactions, the bot is integrated with the bank's secure API.

How to choose the right chatbot solution for your bank

Suppose you are ready to optimize your banking services with a chatbot; it is essential to define its tasks clearly. Decide whether you need 24/7 customer support, help with simple banking operations, or a comprehensive emotion analysis.

It is also essential that the bot can be easily integrated with the bank's IT systems and ensure a high degree of data protection, meeting international standards (ISO/IEC 27001).

Pay attention to the ability to learn and improve the chatbot using machine learning. It is an important aspect if you want to increase the effectiveness of the chatbot over time. Also, check how flexibly the solution can scale and adapt to changing business processes.

Lastly, select proven software development providers with experience in the banking sector to minimize risks and expedite the implementation of the chatbot. Partnering with a reliable software development outsourcing company can further streamline the process and ensure high-quality results.

Final thoughts

AI-based chatbots significantly increase the efficiency of banking services. Namely, they expedite the processing of requests and lower operational costs. We can be certain that their role will continue to grow in the future.

A properly configured bot automates routine processes and enhances the customer experience through personalized and prompt responses. Banks around the world are already using AI for round-the-clock support, analyzing customer emotions, assessing their solvency, detecting fraud, and even for internal audits.

AI is an indispensable tool for financial institutions that want to adapt to their clients' expectations and remain competitive quickly.

FAQ

How secure are AI chatbots in the banking field?

Chatbots for banking should be protected with TLS encryption protocols and need to be fully compliant with ISO/IEC 27001. Select software from reliable chatbot development companies and be confident in your virtual assistant.

What is the difference between rule-based and AI chatbot assistants for banks?

Rule-based bots rely on fixed command sets. However, they lack flexibility and sometimes cannot adapt to new inputs. AI chatbots apply NLP and ML technologies to understand context more deeply. So, they can handle more user requests without human agent assistance.

How do chatbots reduce costs for banks?

Chatbot automation helps to handle customer requests, allowing for quicker and more scalable customer service compared to human customer service. It means banks and other financial institutions can save money on human resources during periods of peak demand.

Can chatbots fully replace human agents in banking?

The debate is ongoing. When it comes to routine operations, the answer is yes. And yet, AI lacks the empathy and emotional intelligence that human agents provide. It means that in cases such as conflict resolution, human agent support is still needed.

Get fast answers to any remaining questions

Thank you.

Your request has been sent successfully.

Your request has been sent successfully.